Founder Q&As

Founder Vlad Hunter Lodzinski answers some common questions he gets from the investor community.

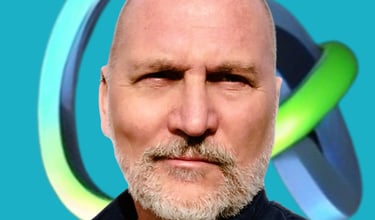

Vlad Hunter Lodzinski

4 min read

We're always happy to engage and answer questions. Use the contact button in the footer or find our social links on the contact us page.

As part of our commitment to transparency, here is a selection of questions, and answers, that we've received in the past.

What's your value proposition?

Our value proposition - faster deal flow - delivers unparalleled efficiency, reduced risk, and enhanced returns.

Stelarator reimagines film finance with a secure, data-driven marketplace. Using a tech stack designed for the unique needs of the filmed entertainment industry, we first replace paper contracts with digitised agreements that understand the clauses within them.

At the core of our due-diligence based offering is that our system understands all the rights and obligations of contract terms across the entire finance workflow, and ultimately audits and predicts the revenue waterfall, capital adequacy, and risk factors.

This functionality triggers further beneficial services, derived from our clean, full finance lifecycle data-points.

AI and other technology streamline workflows and automate processes; embedded due-diligence and data-derived insights accelerate transactions, unlocking capital for creators.

What is the real problem your customers face?

#1 Challenge: Paperwork Purgatory

IP-based entertainment finance is hampered by a maze of opaque contracts. These inefficiencies hinder access to capital, optimal use of funds, and waterfall distribution.

Paper contracts and legacy processes create friction; disjointed workflows fuel litigation; innovation and new entrants are stifled.

Litigation proves how billion-dollar grossing movies like Harry Potter can officially be loss-making. Capital inflow is hampered by slow, uncertain finance lifecycles.

The founder was inspired by personal experience of naïve investors losing money due to contract opaqueness, and successful creators struggling for finance on their next projects.

How do you solve this problem?

Our solution cuts through complexity, starting with Digital Legal Agreements. Our bespoke technology stack uses AI to understand and interconnect multiple contracts' rights and obligations. Whether digitally-originated, or scanned and validated via AI, contract analysis and execution are optimised and automated.

Storytellers AND financiers benefit: We uniquely align these buyers and sellers, fostering mutual benefit through data and live auditing. Creators are empowered via next-gen contract flows, ownership tools, and financial planning. Our research shows 92% of production professionals desire streamlined investment management, with 83% of Indie producers believe transparent dealings attract more capital. We unlock this potential.

As a due-diligence framework, we support fair dealing and process modernisation. Finance partners get de-risked returns and better use of capital, access to more secure opportunities, and data-rich financial forecasts.

Stelarator = better, faster, cheaper. As we iterate, data, automation, and insight further streamline the ecosystem. As a creative or finance head, you ultimately do more of what drives you, more often.

What is your target market and its size?

Stelarator caters to two key client profiles within the $8.5 billion segment of the $240 billion annual filmed entertainment market (Statista, 2023). This market boasts a strong Compound Annual Growth Rate (CAGR) of 5.9% (Business Research Insights, 2023), highlighting the increasing appetite for efficient investment solutions.

Sellers (film & IP owners): production companies, independent producers, and studios seeking streamlined finance management and improved access to capital (e.g. Participant Media, Blumhouse Productions). Of the Majors, Sky (Comcast/ Universal) expressed early interest. Distribution companies: entities managing film rights and revenue streams across various platforms (e.g. Neon, Koch Films).

Buyers: risk investors, like HNWI/Family Offices, and private equity seeking data-driven investment opportunities / tax planning (e.g. Financière Pinault, eOne). Institutional investors: Debt financiers and tax credit authorities preferring transparency and security in film assets (e.g. Film Finances Inc., Georgia (USA) Dept. of Revenue).

Operating with a global mindset, targeting English language and European filmed entertainment product makers and IP owners across theatrical and streaming. Buyer targets reflect the more international nature of financing, so investor and finance communities in the US, UK, and EU, together with global private and institutional capital.

Why now is a good timing for your business?

The time is perfect for Stelarator because of three key trends:

#1 Advancements in AI and Large Language Models (LLMs): These technologies allow us to automatically ingest complex financial contracts, significantly reducing processing times previously associated with legacy systems. This translates to faster deal flow for creators and investors.

#2 Growing acceptance of Fintech solutions: The film finance industry, while traditionally reliant on manual processes, is increasingly recognizing the benefits of technology. Investors are looking for data-driven investment opportunities, and creators need efficient access to capital. Stelarator bridges this gap by providing a secure and transparent platform and ecosystem.

#3 Evolving film finance landscape: The rise of streaming services and data-driven investment strategies is reshaping the film finance market. Our platform is designed to adapt to these changing dynamics and empower creators to focus on their vision while investors gain access to attractive opportunities.

Want to know about our competitive landscape, our Go To Market strategy, our Revenue Model and break even? Just get in touch.

Tell us about the lead team

Vlad Hunter Lodzinski

Relevant experience

Bridging film and future: ex-producer, director, writer and commissioner with a tech startup track record in Europe & California; launching media innovations & empowering creators.

Notable roles include Universal, Warner Bros Discovery and UK’s ITV, recently supporting Comcast in the launch of SkyShowtime. In Los Angeles he mentored aspiring filmmakers, creatives with workshops and panels, utilising his networks and experiences, including on an Andrzej Wajda epic. (Degree: Film Literature)

Role in the business

FilmTech Disruptor. Our Founder & CEO leads our innovative start-up, leveraging combined experiences to tackle investment and waterfall hurdles for our users.

Whatever it takes, from building out prototypes, user fit testing, or finding partners that excel, his focus is to drive forward a singular solution that responds to industry needs, concerns and desires. His end goal: more investment inflow; more democratic, efficient operations - bringing filmmakers and their audiences closer together.

Christopher Ross

Relevant experience

Christopher isn't your typical ops leader. 20+ years in high-pressure tech bring multifaceted experiences that foster excellence and robustness in execution.

His experience in international financial services (JP Morgan, ADP), cyber security (ITC) and fintech start-up (AinFin) ensures an understanding of the fiduciary responsibilities and nimble robustness needed for developing a new to market business platform like Stelarator.

Role in the project

From platform delivery, integration with partners, to daily operational management, Christopher keeps the show on the road. Innovation at Stelarator is fueled by his adaptability, problem-solving and entrepreneurial spirit. Through building an operationally robust, stable platform, he delivers an ecosystem supporting creative ventures – perfect for bringing our film finance vision to life.

As an experienced business and leadership mentor, he also fosters our people culture.

The 21st Century Finance Marketplace

Improving. Optimising. Unleashing the Business of Filmed Entertainment.

Stelarator

Contact

Terms & Conditions

© Stelarator OÜ 2025. All rights reserved.

Find US